Banking, in its simplest form, is the system of institutions and processes that manage money for individuals, businesses, and governments. It’s like the circulatory system of the economy, keeping everything flowing smoothly. But it’s much more than just storing your cash!

Table of Contents

ToggleScheduled Banks:

Regulated by the Reserve Bank of India (RBI), the apex bank of the country, scheduled banks are considered the backbone of the Indian banking system.

Types of Scheduled Banks:

- Commercial Banks: These are the usual suspects – State Bank of India, ICICI Bank, HDFC Bank, etc. They offer a wide range of services like deposit accounts, loans, investments, and international banking.

- Cooperative Banks: Owned by their members, these banks focus on serving specific communities like farmers or professionals.

- Regional Rural Banks: Established to provide credit and banking facilities in rural areas.

- Small Finance Banks: Cater to underbanked sections of the population.

- Payment Banks: Primarily facilitate digital payments and money transfers.

Non-Scheduled Banks:

Operating outside the direct purview of the RBI, these banks are smaller and cater to specific needs or regions. They typically don’t have access to the clearinghouse system, limiting their reach and services.

Examples of Non-Scheduled Banks:

- Local Area Banks: Focus on serving specific communities or areas.

Commercial Banks of India

- Public Sector Banks (12)

- Private Sector Banks (21)

- Foreign Banks

- Small Finance Banks

- Payment Bank

Public Sector Banks (PSBs)

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Bank of Baroda (BoB)

- Canara Bank

- Indian Overseas Bank (IOB)

- Bank of India (BOI)

- Union Bank of India (UBI)

- Central Bank of India (CBI)

- UCO Bank

- Bank of Maharashtra (BoM)

- Indian Bank

- Vijaya Bank

Private Sector Banks (PSBs)

- Axis Bank

- Bandhan Bank

- CSB Bank

- City Union Bank

- DCB Bank

- Dhanlaxmi Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDFC First Bank

- IndusInd Bank

- ING Vysya Bank

- Jammu & Kashmir Bank

- Karnataka Bank

- Kotak Mahindra Bank

- South Indian Bank

- TMB (Tamilnad Mercantile Bank)

- UCO Bank

- Yes Bank

- HDFC Ergo Bank

- AU Small Finance Bank

Foreign Banks

List of Major Foreign Banks in India

- DBS Bank India

- Standard Chartered Bank India

- HSBC India

- Citibank India

- Bank of America

- Deutsche Bank India

- BNP Paribas India

- Barclays Bank India

- Mizuho Bank India

- Sumitomo Mitsui Banking Corporation India

Small Finance Banks

- AU Small Finance Bank

- Capital Small Finance Bank

- Equitas Small Finance Bank

- ESAF Small Finance Bank

- Suryoday Small Finance Bank

- Ujjivan Small Finance Bank

- Jana Small Finance Bank

- FINCA Microfinance Bank

- Hum Saathi Microfinance Bank

- Satin Creditcare Network Limited

- Varada Small Finance Bank

- North Eastern Small Finance Bank

- Padmaja Singhania Finvest Limited

- Aryavart Urban Cooperative Bank

- RBI Small Finance Bank

- Unity Small Finance Bank

- Bandhan Small Finance Bank

- Tamilnad Mercantile Bank

Payment Bank

- Airtel Payments Bank

- Fino Payments Bank

- India Post Payments Bank

- Jio Payments Bank

- Paytm Payments Bank

- NSDL Payments Bank

Payment Banks Limitations

- Deposits upto Rs. 1 Lakh

- Cannot Provide Loan/Credit Card

Regional Rural Banks

| State | RRB | Sponsor Bank |

|---|---|---|

| Andhra Pradesh | Andhra Pragathi Grameena Bank | Indian Bank |

| Andhra Pradesh | Chaitanya Godavari Gramin Bank | Andhra Bank |

| Andhra Pradesh | Saptagiri Grameena Bank | Indian Bank |

| Arunachal Pradesh | Arunachal Pradesh Rural Bank | State Bank of India |

| Assam | Assam Gramin Vikash Bank | United Bank of India |

| Assam | Pragati Rajya Gramin Bank | Canara Bank |

| Bihar | Bihar Gramin Bank | United Bank of India |

| Bihar | Prathama Gramin Bank | Punjab National Bank |

| Bihar | Purvanchal Gramin Bank | United Bank of India |

| Chhattisgarh | Chhattisgarh Gramin Bank | Punjab National Bank |

| Chhattisgarh | Kshetriya Gramin Bank | Bank of Baroda |

| Goa | Goa Rural Bank | Union Bank of India |

| Gujarat | Gujarat Rural Bank | Bank of Baroda |

| Gujarat | Saurashtra Gramin Bank | Union Bank of India |

| Haryana | Haryana Kshetriya Gramin Bank | Punjab National Bank |

| Himachal Pradesh | Himachal Pradesh Gramin Bank | Punjab National Bank |

| Jammu and Kashmir | Jammu and Kashmir Bank | Punjab National Bank |

| Jammu and Kashmir | Jammu & Kashmir Grameen Bank | Punjab National Bank |

| Jharkhand | Jharkhand Gramin Bank | Punjab National Bank |

| Karnataka | Karnataka Gramin Bank | Syndicate Bank |

| Karnataka | Pragathi Grameen Bank | Canara Bank |

| Kerala | Kerala Gramin Bank | Syndicate Bank |

| Madhya Pradesh | Madhya Pradesh Gramin Bank | Punjab National Bank |

| Madhya Pradesh | Narmada Valley Gramin Bank | Syndicate Bank |

| Maharashtra | Maharashtra Gramin Bank | Bank of Maharashtra |

| Maharashtra | Pandharpur District Central Co-operative Bank | Bank of Maharashtra |

| Maharashtra | Pune Urban Co-operative Bank | Bank of Maharashtra |

| Manipur | Manipur Rural Bank | State Bank of India |

| Meghalaya | Meghalaya Rural Bank | State Bank of India |

| Mizoram | Mizoram Rural Bank | State Bank of India |

| Nagaland | Nagaland Rural Bank | State Bank of India |

| Odisha | Utkal Gramin Bank | Oriental Bank of Commerce |

| Odisha | Odisha Gramin Bank | State Bank of India |

| Rajasthan | Baroda Rajasthan Bank of India | Bank of Baroda |

| Rajasthan | Jaipur-Nagaur Anchalik Gramin Bank | UCO Bank |

| Rajasthan | Marwar Gramin Bank | Oriental Bank of Commerce |

| Rajasthan | Mewar Gramin Bank | Syndicate Bank |

| Sikkim | Sikkim Gramin Bank | State Bank of India |

| Tamil Nadu | Tamil Nadu Rural Development Bank | Indian Bank |

| Telangana | Telangana Grameena Bank | Andhra Bank |

| Tripura | Tripura Gramin Bank | State Bank of India |

| Uttar Pradesh | Gorakhpur Kshetriya Gramin Bank | State Bank of India |

| Uttar Pradesh | Kisan Gramin Bank | UCO Bank |

| Uttar Pradesh | Pragati Grameen Bank | Indian Bank |

| Uttar Pradesh | Varadhaman Gramin Bank | Bank of Baroda |

| Uttarakhand | Uttarakhand Gramin Bank | Bank of Baroda |

| West Bengal | Bangiya Gramin Vikas Bank | United Bank of India |

| West Bengal | Barrackpore Gramin Bank | United Bank of India |

| West Bengal | Paschim Banga Gramin Bank | United Bank of India |

Cooperative Banks

Andhra Pradesh

- AP Cooperative Bank

- Andhra Pragathi Grameena Bank

- Chaitanya Godavari Gramin Bank

- Saptagiri Grameena Bank

Arunachal Pradesh

- Arunachal Pradesh Rural Bank

Assam

- Assam Gramin Vikash Bank

- Pragati Rajya Gramin Bank

Bihar

- Bihar Gramin Bank

- Prathama Gramin Bank

- Purvanchal Gramin Bank

Chhattisgarh

- Chhattisgarh Gramin Bank

- Kshetriya Gramin Bank

Gujarat

- Gujarat Gramin Bank

- Saurashtra Gramin Bank

Goa

- Goa Rural Bank

Haryana

- Haryana Kshetriya Gramin Bank

Himachal Pradesh

- Himachal Pradesh Gramin Bank

Jammu and Kashmir

- The Jammu and Kashmir Bank

- Jammu & Kashmir Grameen Bank

Jharkhand

- Jharkhand Gramin Bank

Karnataka

- Karnataka Gramin Bank

- Pragathi Grameen Bank

Kerala

- Kerala Gramin Bank

Madhya Pradesh

- Madhya Pradesh Gramin Bank

- Narmada Valley Gramin Bank

Maharashtra

- Maharashtra Gramin Bank

- Pandharpur District Central Co-operative Bank

- Pune Urban Co-operative Bank

Manipur

- Manipur Rural Bank

Meghalaya

- Meghalaya Rural Bank

Mizoram

- Mizoram Rural Bank

Nagaland

- Nagaland Rural Bank

Odisha

- Utkal Gramin Bank

- Odisha Gramin Bank

Rajasthan

- Baroda Rajasthan Bank of India

- Jaipur-Nagaur Anchalik Gramin Bank

- Marwar Gramin Bank

- Mewar Gramin Bank

Sikkim

- Sikkim Gramin Bank

Tamil Nadu

- Tamil Nadu Rural Development Bank

Telangana

- Telangana Grameena Bank

Tripura

- Tripura Gramin Bank

Uttar Pradesh

- Gorakhpur Kshetriya Gramin Bank

- Kisan Gramin Bank

- Pragati Grameen Bank

- Varadhaman Gramin Bank

Uttarakhand

- Uttarakhand Gramin Bank

West Bengal

- Bangiya Gramin Vikas Bank

- Barrackpore Gramin Bank

- Paschim Banga Gramin Bank

Terms Related To Accounts

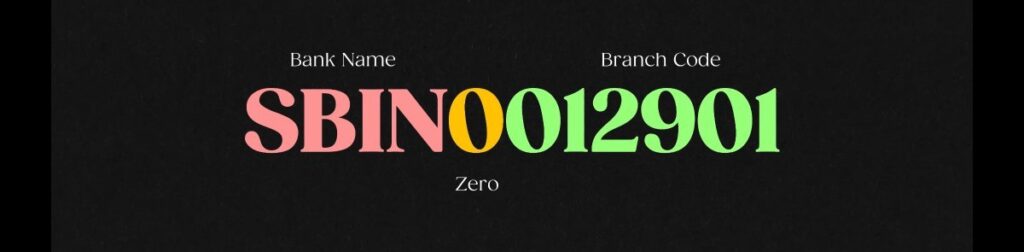

IFSC Code

The IFSC (Indian Financial System Code) is a unique 11-character alphanumeric code assigned to every bank branch in India. It facilitates electronic fund transfers (EFTs) within the country. The IFSC code is used for various transactions, including NEFT, RTGS, and IMPS.

Types of Accounts

Savings Account

A savings account is the most common type of bank account, designed for everyday transactions and saving money. It offers a combination of features, including:

- Interest earned on deposited funds

- ATM/debit card access for withdrawals and purchases

- Online and mobile banking facilities for convenient transactions

- Cheque issuance for making payments

- Suitable for – Personal Use

- Interest rates – 2-4%

joint account

A joint account is a bank account that is owned by two or more people. The account holders can deposit and withdraw money, make payments, and access the account online or through a mobile app. Joint accounts can be helpful for couples, families, or roommates who want to share their finances.

Current Account

A current account is primarily intended for business transactions and high-frequency financial activities. It offers features like:

- No or minimal restrictions on withdrawals

- Higher transaction limits compared to savings accounts

- Overdraft facilities for businesses with approved creditworthiness

- Cheque issuance for business payments

- Suitable for – Traders/Entreprenuers

- Interest rates – 0%

Salary Account

A salary account is a specialized type of savings account offered to salaried individuals. It typically provides benefits such as:

- Zero-balance or low-maintenance charges

- Interest on deposited funds

- Pre-approved loans or overdraft facilities

- Salary auto-credit feature for direct transfer of wages

Fixed Deposit (FD) Account

A fixed deposit account is a secure investment option where you lock in a fixed interest rate for a predetermined period. It offers:

- Guaranteed returns on invested funds

- Flexible maturity options to suit individual needs

- Safeguarding of funds against market fluctuations

- Interest rates – Upto 9%

Recurring Deposit (RD) Account

A recurring deposit account is a savings plan that encourages regular savings habits. It involves depositing a fixed amount periodically over a chosen tenure. Features include:

- Systematic savings discipline

- Interest earned on accumulated deposits

- Maturity lump sum payment

- Interest rates – Upto 9%

LOAN Account

A loan account is an agreement between a borrower and a lender, in which the lender provides the borrower with a sum of money to be repaid over time, typically with interest. Loans are used for various purposes, such as purchasing a home, financing a car, consolidating debt, or funding a business venture.

NRI Account

An NRI (Non-Resident Indian) account is designed for Indian citizens residing abroad. It offers features like:

- Repatriation of funds to India

- Investment opportunities in India

- Tax-saving benefits for NRI investments

- Interest rates – 5-7%

Other Types of Accounts

In addition to the primary account types mentioned above, Indian banks also offer specialized accounts for specific purposes, such as:

- Student Accounts: Designed for educational expenses and financial management

- Senior Citizen Accounts: Tailored for the needs of older adults with special benefits

- Women’s Accounts: Focused on empowering women through financial literacy and access

- Children’s Accounts: Encourage savings habits and financial education from a young age

KYC

KYC stands for “Know Your Customer”. It is a process that banks use to verify the identity and address of their customers. This is important because it helps to prevent money laundering and other financial crimes.

Types of KYC documents

- Proof of identity: This could include a passport, driver’s license, or other government-issued ID.

- Address Proof: This could include a utility bill, bank statement, or lease agreement.

- Proof of income: This could include a pay stub, tax return, or W-2 form.

Account Number

An account number is a unique identifier used by banks and other financial institutions to track customer accounts. It is typically a 10-14 digit number that is assigned to each account when it is opened.

Nominee

A nominee is a person who is appointed by the account holder to receive the funds in the account in the event of the account holder’s death. Nominee is also called a beneficiary.

Minimum balance

Minimum balance is the minimum amount of money that a bank requires a customer to keep in a bank account at all times. Banks set minimum balances to cover the costs of providing banking services, such as processing transactions, providing customer service, and maintaining ATMs.

zero-balance account

A zero-balance account is a bank account that does not require a minimum balance to be maintained. This type of account is often offered to students, seniors, or people with low incomes.

Account Balance

An account balance is the amount of money that is currently available in a financial account. The account balance is calculated by adding up all of the deposits and credits to the account, and then subtracting all of the withdrawals and debits.

Usable balance

The usable balance of a bank account is the amount of money that the account holder can currently access for spending, withdrawals, or transfers. It is calculated by subtracting any pending or outstanding transactions from the account’s overall balance.

Debit and Credit

Debit and credit are two common financial terms that are often used interchangeably, but they actually have distinct meanings and applications.

In simple terms, debit refers to an outflow of funds, while credit refers to an inflow of funds.

Passbook

A passbook is a record of all the transactions that have taken place in a bank account. It is a physical booklet that is given to the account holder when the account is opened.

A passbook typically contains the following information:

- Account holder’s name and address

- Transaction history (deposits, withdrawals, transfers, etc.)

- Account type number(e.g., savings, checking)

- Account balance

Account Statement

An account statement, also known as a bank statement, is a financial document that summarizes a customer’s account activity over a specific period of time.

Terms Related To Deposits

Term Deposits

A term deposit, also known as a fixed deposit (FD) or time deposit, is a type of savings account that offers a fixed interest rate for a predetermined period. This means that you know exactly how much interest you will earn on your deposit, regardless of changes in market interest rates.

Interest Rate

The Interest rate is the percentage of the principal amount of a loan or deposit that is charged or earned each period, typically a year, as a fee for the use of funds. These are determined by a variety of factors, including the borrower’s creditworthiness, the risk of the investment, and the overall economic environment.

There are two main types of interest rates:

- Fixed interest rates: These rates remain the same for the entire term of the loan or deposit.

- Variable interest rates: These rates can fluctuate over time, based on an index or benchmark.

Annual Percentage Rate

The annual percentage rate (APR) is a measure of the interest rate charged on a loan or earned on an investment over a year. It is expressed as a percentage and is used to compare the costs of different loans or investments.

TDS

TDS or Tax Deducted at Source, is a system in India where certain parties are required to deduct tax from payments they make to others. This is done to ensure that the government receives its revenue upfront, rather than having to wait until taxpayers file their returns.

Terms Related To Payments

Beneficiary

A beneficiary in bank payments is the person or entity who receives the funds from a transaction. The beneficiary is typically identified by their name, account number.

VPA

VPA stands for Virtual Payment Address. It is a unique identifier that is used to make payments through the Unified Payments Interface (UPI) system in India. UPI is a real-time payment system that allows users to transfer money between bank accounts instantly using their mobile devices.

USSD

USSD (Unstructured Supplementary Service Data) is a type of mobile communication technology that allows users to interact with applications and services using a simple menu system. In the context of bank payments, USSD can be used to perform a variety of transactions, including checking account balances, transferring funds, and making payments.

Digital Rupee

Digital Rupee, also known as e₹, is a central bank digital currency (CBDC) issued by the Reserve Bank of India (RBI). It is a digital form of the Indian rupee and is intended to provide a secure and convenient way for people to make payments.

ASBA

The Application Supported by Blocked Amount (ASBA) facility is a payment mechanism for subscribing to Initial Public Offers (IPOs) in India. It allows investors to block the amount they wish to invest in an IPO without actually debiting it from their bank account. This is particularly beneficial for investors who want to ensure they have sufficient funds to cover their IPO subscription before they are allotted shares.

E-Mandate

E-Mandate, also known as Electronic Mandate (e-Mandate), is a digital authorization system that allows bank account holders to set up standing instructions for recurring payments. It is a convenient and secure way to make regular payments, such as utility bills, EMIs, and insurance premiums.

Cheques

A cheque is a written order to a bank to pay a specified amount of money to a specific person or entity. It is a convenient way to make payments, as it can be used to pay for goods and services, as well as to transfer money to other people.

Demand Drafts

A demand draft, also known as a banker’s draft, is a pre-paid instrument issued by a bank on its own behalf. It guarantees payment to the recipient on demand. Demand drafts are typically used for larger payments, such as those made for property transactions or investments.

Payee

The payee is the person or entity that receives payment in a financial transaction. They are the beneficiary of the payment and the one to whom the funds are ultimately directed. In bank payments, the payee is typically identified by their name, account number, or other identifying information.

- Drawer: The person or entity who creates the payment instrument (e.g., check, bill of exchange) and authorizes the payment.

- Drawee: The bank or other financial institution that is instructed to make the payment.

- Payee: The person or entity who receives the payment.

MICR

MICR stands for Magnetic Ink Character Recognition. It is a technology that uses magnetic ink to print characters on the bottom of checks and other financial documents. These characters can be read by machines, which helps to automate the processing of checks and other payments.

PPS

Positive Pay System (PPS) is an electronic authentication system for cheque payments that helps to prevent fraud and ensure that cheques are paid to the correct person. It is used by banks in India to verify the authenticity of cheques before they are cleared.

Cancelled Cheque

A cancelled cheque is a cheque with two parallel lines drawn across the layout. These lines indicate that the cheque has been paid and is no longer valid for use. The word “CANCELLED” is often written between the lines for emphasis.

Note : A cancelled cheque does not require a signature.

Cheque Bounce

A bounced cheque, also known as a dishonored cheque, is a cheque that is rejected by the bank for insufficient funds in the account holder’s account. This can occur when the account holder writes a cheque for an amount that exceeds their available balance.

Debit Card

A debit card is a payment card that deducts money directly from the cardholder’s bank account when used to make purchases. Debit cards can be used to withdraw cash from ATMs, make purchases at stores, and pay bills online. They offer convenience and security for everyday transactions.

Credit Card

Credit cards are a type of payment card that allows you to borrow money from a bank or other financial institution to make purchases. You can use your credit card to buy goods and services, online or in person. You can also use your credit card to withdraw cash at ATMs.

Forex Card

A forex card, also known as a travel card or currency card, is a prepaid card that can be used to make payments and withdraw cash in foreign currencies. Forex cards are a convenient and secure way to carry foreign currency when traveling abroad, as they eliminate the need to exchange large amounts of cash at unfavorable rates.

Card Networks

There are four major card networks in the world:

- Visa: Visa is the largest card network in the world, with over 3.2 billion cards issued in over 200 countries and territories.

- Mastercard: Mastercard is the second-largest card network in the world, with over 2.9 billion cards issued in over 210 countries and territories.

- American Express: American Express is a global payments and travel company that issues its own branded cards, as well as co-branded cards with other banks and institutions.

- Discover: Discover is a major card network in the United States, with over 150 million cards issued.

CVV

CVV stands for Card Verification Value. It is a 3 or 4 digit number printed on the back of most credit and debit cards. It is used to verify the identity of the cardholder when making online or phone transactions.

Basis points

Basis points (bps) are a unit of measurement used to describe the percentage change in the value or rate of a financial instrument. One basis point is equal to 0.01%, or 0.0001 in decimal form.

For example, if an interest rate rises from 5% to 5.05%, this is an increase of 5 basis points.

Repo Rate

The repo rate is the rate at which banks borrow money from the central bank.

Reverse Repo Rate

The reverse repo rate is the rate at which the central bank of a country borrows money from commercial banks within the country.

RBI Ombudsman

The Reserve Bank of India (RBI) Ombudsman is a quasi-judicial authority established by the Reserve Bank of India to redress customer complaints against deficiency in banking services. The Ombudsman Scheme was introduced in 2006 to provide a speedy and inexpensive mechanism for resolving customer complaints.