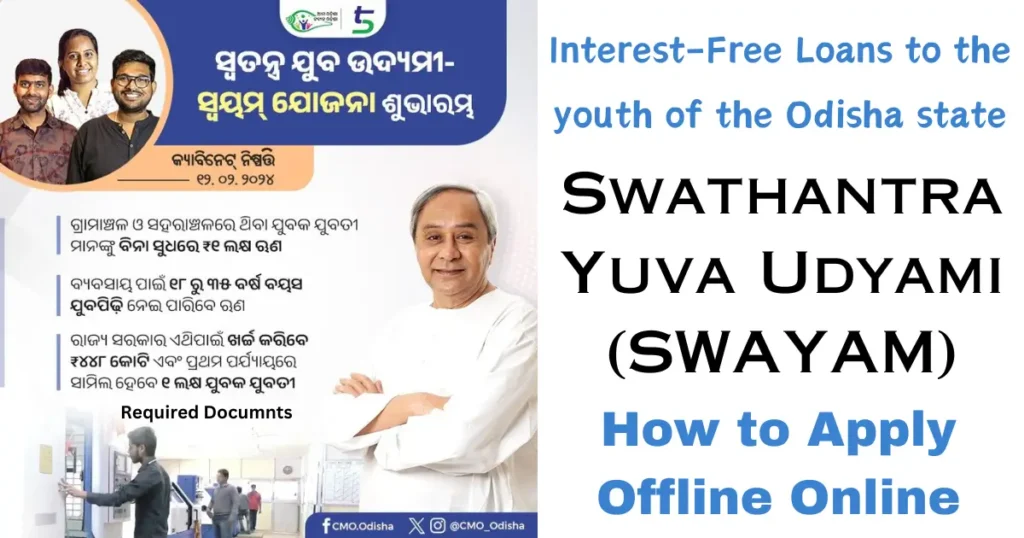

Odisha Swayam : Odisha government launched the Swathantra Yuva Udyami (SWAYAM) Scheme in 2023, aiming to empower young people in the state by providing them with interest-free loans to start or expand their businesses.

Table of Contents

ToggleWhat is the SWAYAM Scheme?

SWAYAM translates to “Self-Reliant Young Entrepreneur” and aims to tackle unemployment and encourage self-employment among the youth. The scheme offers interest-free loans up to Rs. 1 lakh to eligible individuals aged 18-35 (40 for special categories) residing in rural areas of Odisha.

Swayam Yojana Odisha Start Date : The launch date of the SWAYAM Yojana in Odisha has been announced. The Chief Minister of Odisha, Naveen Patnaik, announced the scheme on 22nd February 2023. The scheme will be launched on 1st April 2023, on the occasion of Utkal Divas.

Key Benefits of the SWAYAM Scheme in 2024

- Financial assistance: The interest-free loan removes a major financial hurdle for young entrepreneurs, making it easier for them to get their businesses off the ground.

- Reduced risk: Starting a business is inherently risky. SWAYAM eliminates the burden of interest payments, allowing entrepreneurs to focus on their business growth.

- Boosts self-reliance: The scheme promotes a culture of self-employment and empowers young people to take charge of their own futures.

- Economic development: By supporting small businesses, SWAYAM has the potential to contribute significantly to the economic development of Odisha.

Who Can Avail the Scheme? [Eligibility]

- Rural youth aged 18-35 (40 for SC/ST/PWD) with no outstanding loans for similar purposes.

- Individuals who are unemployed or underemployed.

- Those seeking to start a new business or expand an existing one.

Documents Required For Odisha Swayam Yojana Loan 2024

Mandatory:

- Aadhaar Card: Proof of identity and residence.

- PAN Card: For tax purposes.

- Passport-size photograph: Recent photograph.

- Bank account details: Account number, bank branch details, IFSC code.

- Domicile certificate: Proof of residence in Odisha.

- Project proposal: Detailed description of your business idea, including cost estimation and financial projections.

Additional documents (may vary depending on your specific situation):

- Caste certificate: If applicable, for SC/ST/OBC categories.

- Disability certificate: If applicable, for PWD category.

- Educational certificates: Proof of educational qualifications (may not be required for all categories).

- Skill certificates: Any relevant skill certificates you possess.

- Land ownership documents: If your business involves land ownership.

- Trade license or registration certificate: If your business already exists.

Odisha swayam scheme apply online 2024

Swayam yojana apply online: There is no online application process for the Odisha SWAYAM Scheme.

So no option for Swayam yojana odisha online registration At Present. currently no last date for Apply Application.

How to Apply Offline For Swayam Scheme Odisha Registration 2024

- Visit your nearest Mission Shakti office or Block Level Officer (BLO). These offices are located throughout the state and act as nodal points for the scheme.

- Collect the application form pdf and fill it out accurately with all the required information.

- Attach the necessary documents as mentioned in the application form. These might include your age proof, residence proof, caste certificate (if applicable), and business plan.

- Submit the completed application form along with the documents to the Mission Shakti office or BLO.

- A verification process will be conducted, and upon approval, the loan amount will be disbursed to your bank account.

Consider alternative resources. While waiting for the online application portal, you can explore other resources and programs that support entrepreneurship in Odisha.

key features of the Odisha SWAYAM Yojana 2024

- Eligibility: Unemployed or underemployed youth in the age group of 18-35 years (40 years for SC/ST/PWD) who are residents of rural areas of Odisha are eligible to apply for the scheme.

- Loan amount: The maximum loan amount that can be availed under the scheme is Rs 1 lakh.

- Interest rate: The loan will be provided at an interest rate of 0%.

- Repayment period: The loan has to be repaid within a period of 7 years.

- Margin money: The applicant will have to contribute 10% of the project cost as margin money.

Good news! The SWAYAM Yojana loan is completely free of collateral and processing fees. This means you don’t need to worry about any upfront costs or securing your loan with assets. On top of that, you have four years to repay the full loan amount at your own pace.

Objectives of the SWAYAM Odisha Yojana 2024

- Spark self-employment & entrepreneurship: Empower rural youth to start businesses, combating unemployment.

- Empower youth & reduce unemployment: Give young people resources to become financially independent.

- Boost rural economic growth: Encourage new businesses in rural areas, improving infrastructure & living standards.

- Promote innovation & diversification: Support diverse business ideas, strengthening the state’s economy.

- Bridge the gender gap: Encourage women’s participation in entrepreneurship, closing the gender gap.